India’s first integrated omnichannel financial services platform

Sign up Now

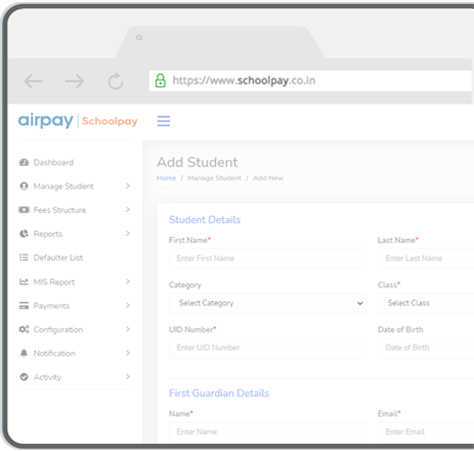

Education

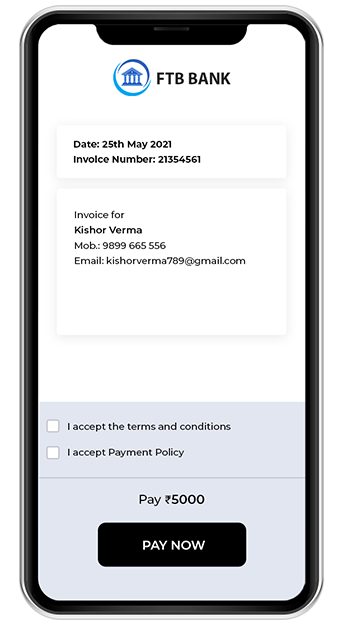

Does your institute struggle with fee collection? schoolpay - a secure, end-to-end cashless payment solution for institutions and parents

Enabling seamless transactions from a single platform while maintaining the highest levels of security.

Know More

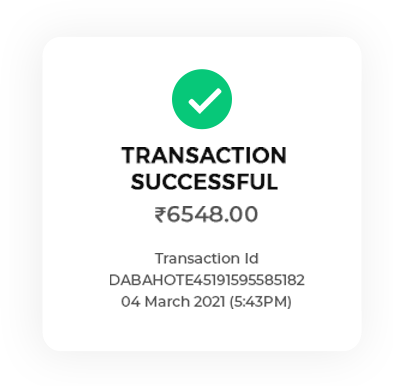

Hospitality

Do you want to improve your customer experience? Enriching Payment Experiences for Hotels & Restaurants

Our Payments product suite is designed to provide a seamless payment experience for your customers

Know More

Retail

Are your customers demanding more ways to pay? Now get quick and hassle-free digital payments for your Retail Outlet

It is a fantastic match! Both you and airpay offer an omnichannel experience.

Know More

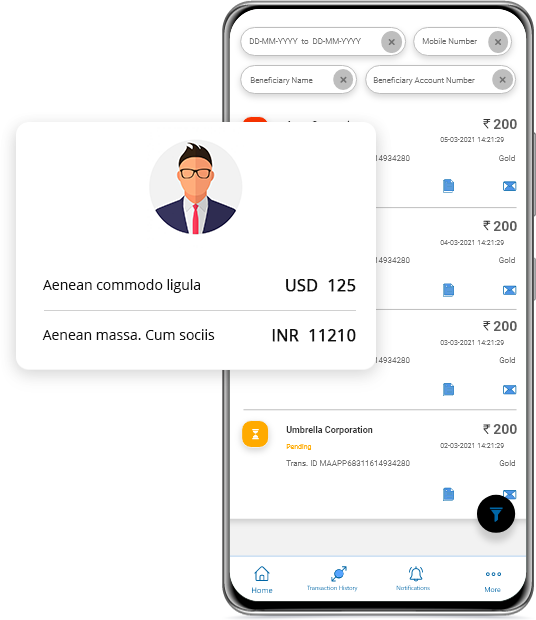

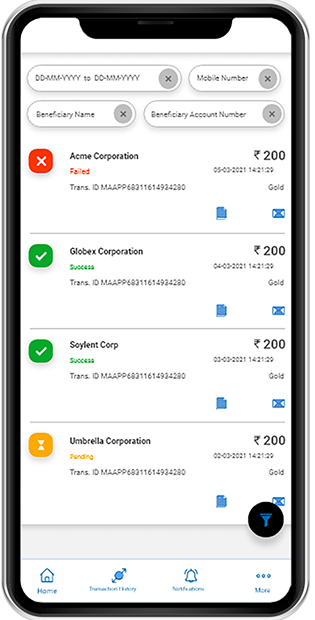

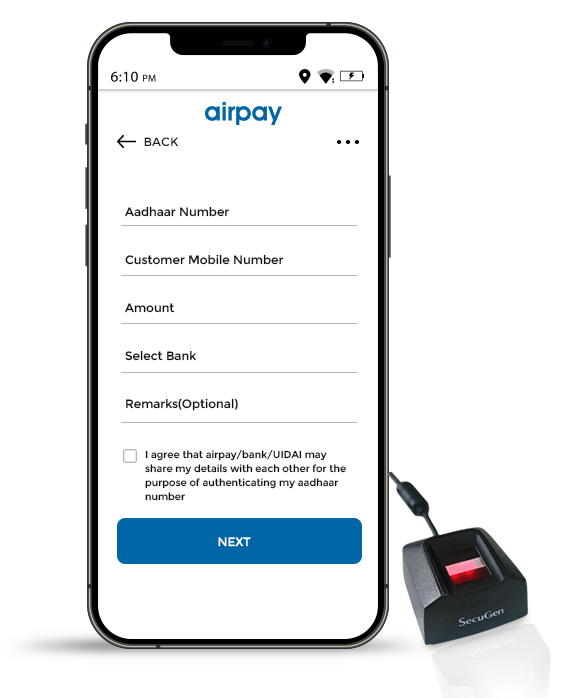

Financial Institutions

Customers are demanding better service!

They want to transact outside of your bank branch, and airpay Human ATM is the solution

Extend digital banking services at zero capital investment through a portable biometric android device

Know More

Logistics

You manage logistics, and we handle payment logistics for you

Whether it is customers who pay you for services or you are paying vendors. We have the most efficient solution to be delivered to you

Know More